Discovering Restaurant Competition at Scale Using Data Science

Learn how techniques using data, statistics and some math can help analyze competitors, optimize pricing strategies, and grow your market share. Discover your culinary rivals today.

Eshwaran Venkat

Co-Founder & CTO

Why It Matters

"If you know the enemy and know yourself, you need not fear the result of a hundred battles" ~ Sun Tzu, The Art of War.

The restaurant industry is a battleground— a delicious, ever-evolving field where success requires more than just incredible food and service. A local café for instance, understood its true competition and used that knowledge to increase foot traffic by 20% in just six months.

To truly thrive, you need strategic insight into your culinary rivals. Forget outdated notions of simply scoping out menus across the street, but now understand who's vying for the same slice of the culinary pie – your customers.

Think beyond cuisine.

- Are you battling for the same lunch crowd with similar price points?

- Do you share a target audience, perhaps families or late-night diners?

- Even your online presence and marketing strategies factor into the equation.

Imagine knowing precisely where your restaurant’s territory overlaps with competitors and where you stand apart. Without a data-driven view of the competitive landscape, you're flying blind—but with it, you can make calculated moves that lead to greater success.

The Recipe for Competitive Intelligence

Forget backroom deals and cloak-and-dagger tactics. We doesn't need to access confidential sales figures or customer lists to decipher the competitive landscape. Instead, we can harness the power of publicly available information, transforming it into a treasure trove of actionable insights.

Tip

Think of it as a culinary Sherlock Holmes, piecing together seemingly disparate clues to reveal the hidden patterns of competition.

We cook up competitor analysis with these ingredients:

- Menu Mining: Dissecting menus, analyzing ingredients, dish descriptions, and culinary styles to understand each restaurant's core offerings and target audience.

- Pricing Distributions: By examining price distributions across menus, which restaurants are competing for customers with similar budgets.

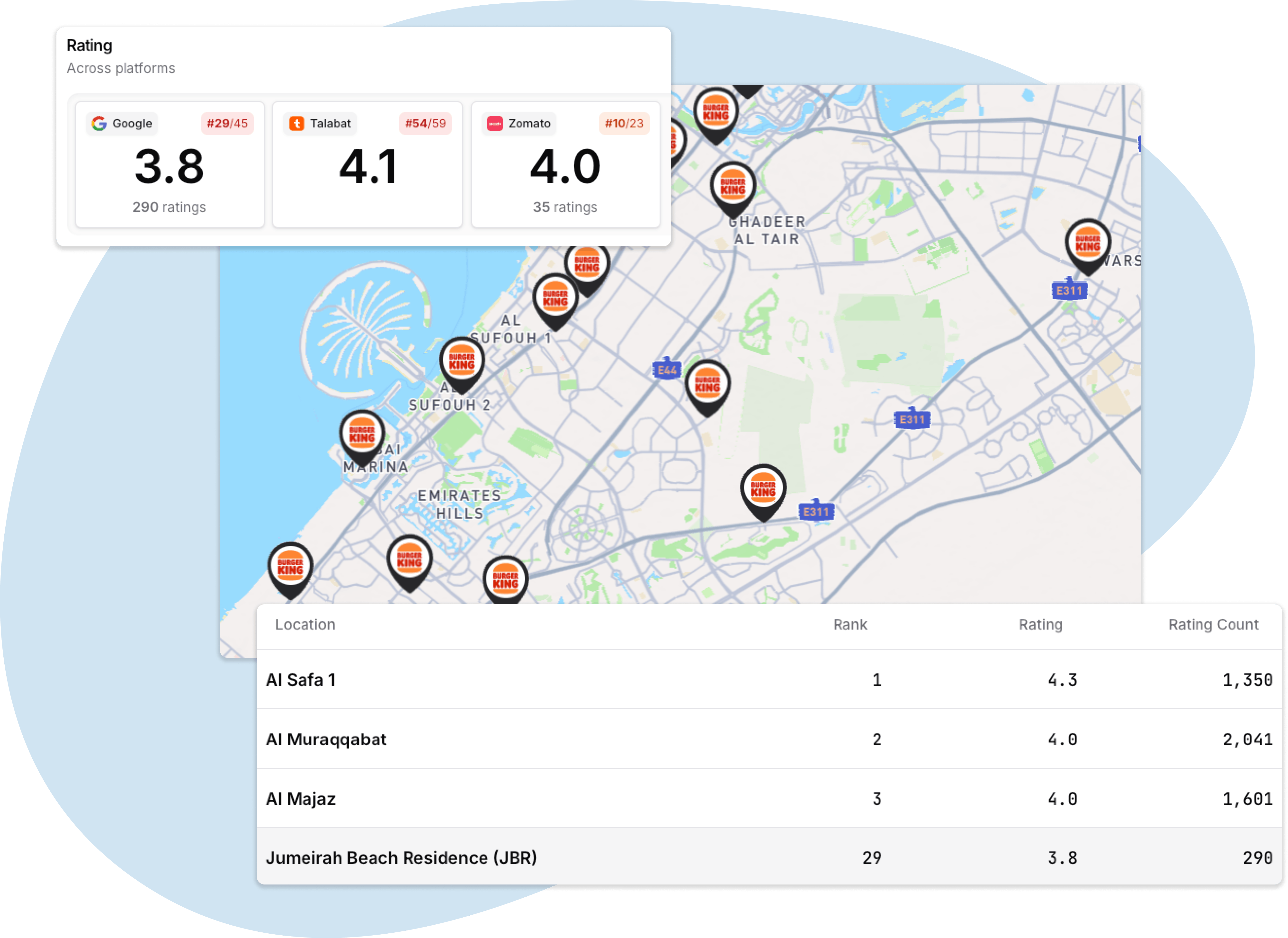

- Location, Location, Location: Mapping out restaurant locations unveils crucial overlaps and those vying for dominance in specific neighborhoods.

- Sizing Up the Competition: We consider the size and reach of brands, recognizing that a local bistro faces different competitive pressures than a national chain.

By weaving together these threads of information, We can create a dynamic tapestry of the competitive landscape and measure the impact of each factor, revealing which restaurants are true rivals and how their actions ripple through the market.

Similar Menus by Keywords

Note

📐 Cosine similarities between preprocessed menu token-frequencies

Imagine each restaurant's menu as a unique language, filled with words that describe their culinary offerings. We transform each menu, removing any brand-specific jargon to focus on the essential ingredients. Then, we break down these menus into individual words, like burger, fries, or salad, creating a culinary fingerprint that reveals the prevalence of different dishes. Restaurants with similar menus – those using the same culinary vocabulary – will have fingerprints that closely resemble each other.

Overlapping Price Distributions

Note

📏 Euclidean distances between outlier reduced pricing distributions

Imagine lining up all the menu items from cheapest to most expensive. Our price signature for a brand captures key points along that line: the lowest price, the highest, the middle price, and a couple in between. This gives us a more complete picture than just the average cost (ensuring that pesky sauces, or a high-end steak don't get in the way). Restaurants with similar pricing strategies – lots of budget options, a wide range of prices, etc. – will be clustered close together. Those appealing to a very different customer wallet will be further apart.

The pricing strategies of Godiva and Cafe Bateel differentiate them from the competitive landscape occupied by Caribou Coffee, Costa Coffee, and Starbucks, who are engaged in direct price competition with one another.

Operating in Similar Locations

Note

📍Intersecting neighbourhoods with one-hot encoded locations.

Imagine a map with each neighborhood outlined. Now picture each restaurant brand claiming its territory by placing a flag in every neighborhood where it has an outlet (like in the board game RISK). This allows us to see which brands are truly competing on the same turf.

A nationwide chain might seem like a distant competitor to your local mom-n-pop shop, but it's the branch just down the street that's vying for the same customers. Our location analysis zooms in on these local skirmishes, highlighting which restaurants are competing for the same hungry diners in each area. With a hyperlocal view of overlapping territories, we reveal the true battlegrounds.

Big vs. Small Comparisons

Note

⚖️ Log-Scaling the number of outlets

A small, local bistro can be a fierce competitor to a national chain. To account for this, we use the logarithm of the number of outlets for each brand. This logarithmic transformation allows us to compare brands of vastly different sizes while still acknowledging the influence of larger players.

Examining the Results

Important

Let's take an example of Starbucks and see where a sample of similar brands stack up with this algorithm.

The following graph represents various brands that show up along X, Y and Z axes when considering menu, price and location similarity scores as assigned by our algorithms in the United Arab Emirates 🇦🇪. Notice how Caribou Coffee and Costa Coffee have high similarity scores on all three axes, because these are large chains that have a similar menu and price point to Starbucks. Following this, there are a cluster of brands that are highly similar by menu, but not always by price or location.

Caution

You will also find Baskin Robbins, which is not a coffee brand show up because it has a high location similarity to Starbucks. This doesn't mean that we consider Baskin Robbins a competitor to Starbucks, but merely that it has a high location intersection - meaning it operates in nearly the same neighbourhoods that Starbucks does.

A competitor would be one that has a higher score on two or more axes, and ideally along all three - categorized as different types of competiton (for example, local to neighbourhood vs. country-wide chain).

How This is Used

These indexed competitors aren't just theoretical groupings. They're the driving force behind the "auto-magic" recommendations you see in the Dotlas application. Whether you're browsing menus, checking out promotions, or analyzing market trends in your area, our platform uses these competitor relationships to enrich your experience with relevant context.

Tip

Curious about how your restaurant stacks up against the competition? Try it out for yourself— See real-time insights by booking a demo today.

But we don't stop there. Dotlas thrives on the power of user feedback, continuously refining our algorithms to deliver truly personalized insights. Your feedback directly influences how we enhance our recommendations, making Dotlas an evolving tool that adapts to the ever-changing dynamics of the restaurant industry.

Our platform learns from these interactions, constantly refining its understanding of the competitive landscape to serve up even more relevant and insightful recommendations. This collaborative approach ensures that our solution remains a dynamic and evolving tool, always adapting to the ever-changing dynamics of the restaurant world.

Bon Appétit!